ACVS Foundation

The mission of the ACVS Foundation is to support the advancement of surgical care of all animals. As an independently-chartered nonprofit philanthropic organization, the ACVS Foundation is devoted to the advancement of surgical care of all animals through funding of educational and research opportunities for veterinary surgery residents and board-certified veterinary surgeons.

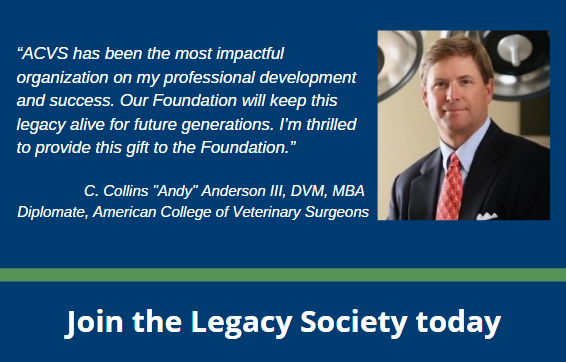

Legacy Society

Legacy Society members are individuals who have generously included the ACVS Foundation in their estate planning. The members demonstrate their commitment to the unequivocal value of education and research to animals, future surgeons, their colleagues, and the profession for years to come. There is no minimum commitment to join the Legacy Society.