ACVS Foundation

The mission of the ACVS Foundation is to support the advancement of surgical care of all animals. As an independently-chartered nonprofit philanthropic organization, the ACVS Foundation is devoted to the advancement of surgical care of all animals through funding of educational and research opportunities for veterinary surgery residents and board-certified veterinary surgeons.

Required Minimum Distribution Program

The required minimum distribution (RMD) is the minimum amount you must withdraw annually from your IRA, SEP IRA, SIMPLE IRA, or retirement plan accounts when you reach age 72 (70 ½ if you reached 70 ½ before January 1, 2020). The RMD must be withdrawn by December 31.

If you choose to not take your RMD, the IRS will penalize you by subjecting the amount that was not withdrawn to a 50 percent tax. If you do take your RMD, that amount is subject to taxation based on your current tax bracket. These funds are subject to taxation because they were withdrawn from retirement accounts that had been funded by pre-tax dollars and a deferred tax liability now exists.

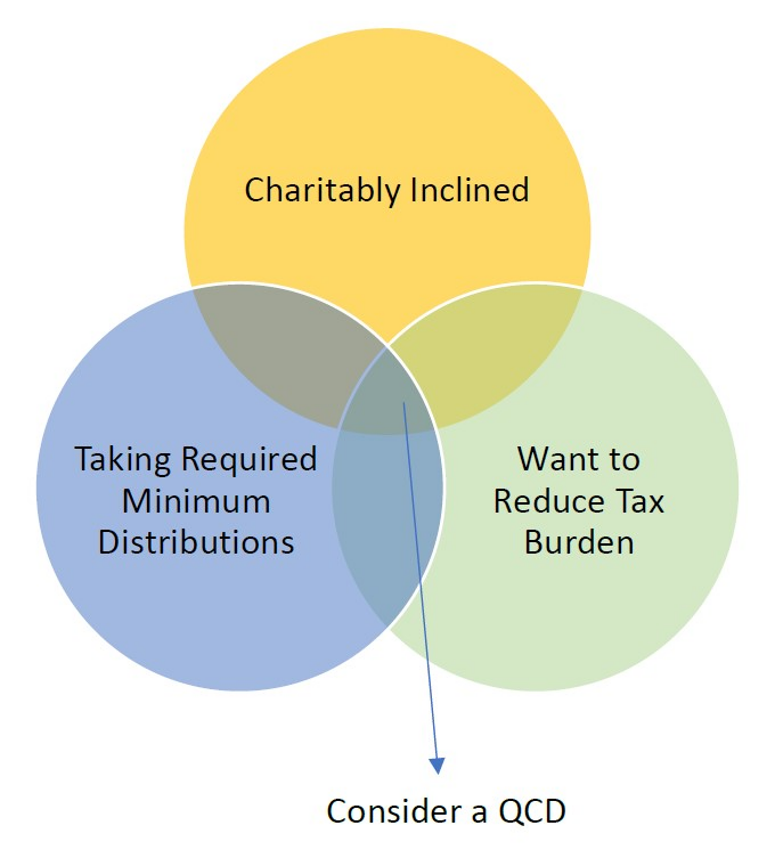

A practical way to satisfy your RMD and avoid the tax implications is to make a direct transfer of funds from your IRA to a qualified charity through a qualified charitable distribution (QCD). This method keeps your taxable income lower and may reduce the impact to certain tax credits and deductions, including Social Security and Medicare.

The ACVS Foundation is a qualifying 501(c)(3) charity that is eligible to receive tax-deductible contributions and is therefore eligible to receive the QCD.

For more information about the eligibility of your plan and the requirements of the QCD, please consult your tax or financial advisor. To discuss a donation to the ACVS Foundation, please contact Shana Rosenblatt, (301) 916-0200 x110 or srosenblatt@acvs.org.